Blog

When Private Equity Meets the Data Center Gold Rush

Analysis

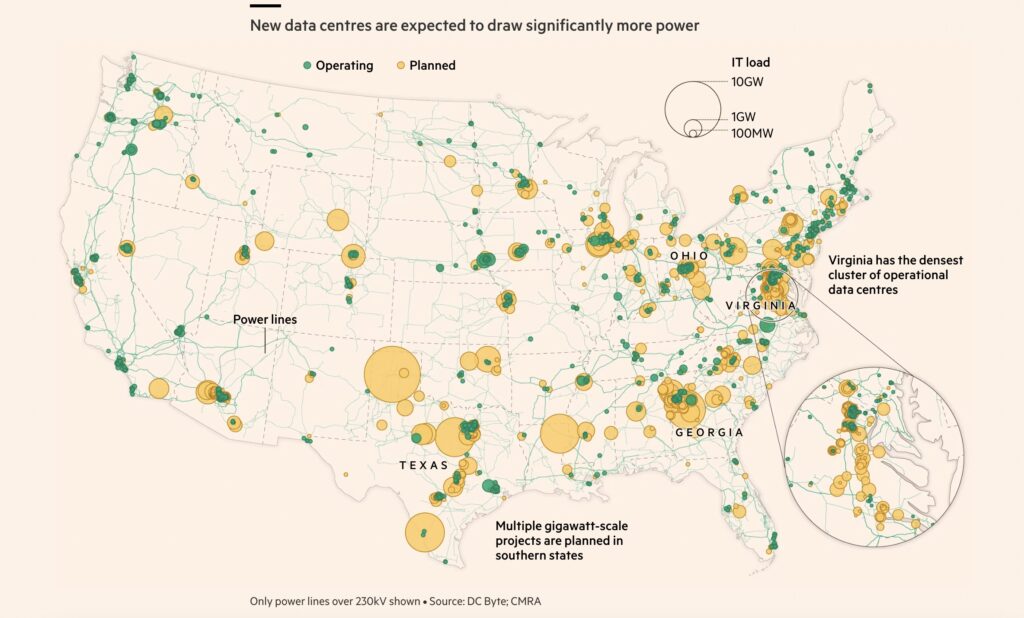

The first generation of data center hubs emerged near fiber networks and major metros, but AI has changed the scale of demand. Projects that once required 5-20 megawatts now request 100-300 megawatts at a time, making electrical certainty more valuable than downtown addresses. As Tier-1 markets reach capacity, operators are moving into exurban and rural corridors with access to transmission, water, incentives, and a cooperative permitting culture.

From Georgetown’s campus and the Steers Center for Global Real Assets, it’s less than an hour northwest to “Data Center Alley” in Ashburn, Virginia, the world’s largest data center hub. On the Dulles Toll Road from Washington Dulles International Airport to downtown Washington, D.C, the pattern is hard to miss; empty fields have turned into rows of windowless shells, bracketed by substations and high-voltage lines.

U.S. Tier-1 clusters – Northern Virginia (Ashburn), Atlanta, Silicon Valley (Santa Clara), Dallas, Chicago, Phoenix, Hillsboro – formed where four ingredients overlapped:

Once the first wave of data centers arrived, network density, utilities, and specialized labor followed. This created the perfect firestorm; more electrical and operational certainty allowed more data centers to enter the market, which then gave more certainty to those same vendors to keep providing in that market.

However, those T1-clusters are becoming capped. According to CBRE’s H1 2025 report, primary North American data-center markets hit a record-low 1.6% vacancy, with Northern Virginia the largest market and among the tightest.

JLL notes that pre-leasing sits around 73%, meaning most capacity is spoken for years before delivery, keeping vacancy restrictive through at least 2027.

In practice, that means:

Hubs like Northern Virginia still matter, but they can’t absorb all of the AI era’s new demand. So, where is all this new data center development activity going?

On a geographical map, many next-wave data center sites look like they’re in the middle of nowhere: exurban cornfields, timber tracts, industrial parcels outside small towns. On a grid map, they’re on top of the action.

As the original cluster crowds out, developers are looking to more non-traditional markets to develop. They’re chasing the following ingredients:

That’s why you see emerging hot spots in places like:

“Rural” in this context doesn’t mean remote in the traditional sense, it means adjacent to wires, water, permits, and willing partners, even if the nearest central business district is over an hour away.

The reason all of this matters now is simple: AI is hungry.

One generative AI training campus can request 100-300 MW on day one, the equivalent of powering 80,000+ homes. Instead of incremental expansion, hyperscalers want baseload commitments, often 10-20 years long. McKinsey estimates that data centers could account for 30-40% of all net new U.S. electricity demand through 2030, with roughly 400 TWh of added consumption ~23% CAGR.

Other analyses suggest global data-center power demand could more than triple by 2030 as AI workloads scale.

For real-assets investors and utilities, that translates into:

As hyperscalers race to secure capacity, they’re less focused on a downtown ZIP code and more on one question: Can you energize 100-300 MW on a realistic timeline, and then double it?

Louisiana is a textbook example of how a power-first strategy can turn a “non-hub” state into an AI anchor.

In August 2025, Louisiana’s Public Service Commission approved Entergy Louisiana’s proposal to move forward on major generation and transmission investments as part of Meta’s planned mega-campus in Richland Parish. When completed, this will be Meta’s largest data center globally, with an announced investment of around $10 billion.

A few things make this notable:

Here, Meta asked: “Which jurisdiction will guarantee the energy?” Louisiana answered with a credible, long-term power plan and political alignment.

That’s how a region that looks “middle of nowhere” on a hiring map becomes “center of everything” on an AI-power map.

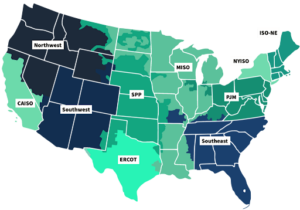

Zooming out, you can see how different grids shape the new geography:

Investors should view this not as a list of states, but as a menu of grid philosophies and regulatory behaviors.

The geography of AI infrastructure is undergoing rapid change.

From a car window on the Dulles Toll Road, those low, windowless buildings might look anonymous & misplaced. From a real-assets lens, they’re signposts for where power, policy, and AI demand intersect, and they’re quietly redrawing the map of the U.S. economy.

Blog

Analysis

Blog